32+ arkansas payroll tax calculator

Ad Process Payroll Faster Easier With ADP Payroll. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

Arkansas Paycheck Calculator Tax Year 2023

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

. Select a State Annual Wage. The State of Arkansas levies a progressive tax rate which means the tax increases with a higher income. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Web Arkansas AR State Payroll Taxes Now that weve gone through federal payroll taxes lets look at Arkansas state income taxes.

Lets Talk ADP Payroll Benefits Insurance Time Talent HR More. For example if an employee earns 1500 per week the. This marginal tax rate means that your.

Web Our employer tax calculator quickly gives you a clearer picture of all the payroll taxes youll owe when bringing on a new employee. Get Started With ADP Payroll. In 2023 the tax rates ranged.

Web If you make 70000 a year living in Arkansas you will be taxed 11683. Web Free Federal and Arkansas Paycheck Withholding Calculator. Get Your Quote Today with SurePayroll.

Ad Process Payroll Faster Easier With ADP Payroll. The state charges a progressive. Web If you make 55000 a year living in the region of Arkansas USA you will be taxed 11033.

Web Estimate how much youll owe in federal taxes for tax year 2022 using your income deductions and credits all in just a few steps with our tax calculator. Hourly Salary Take Home After Taxes SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Free Unbiased Reviews Top Picks.

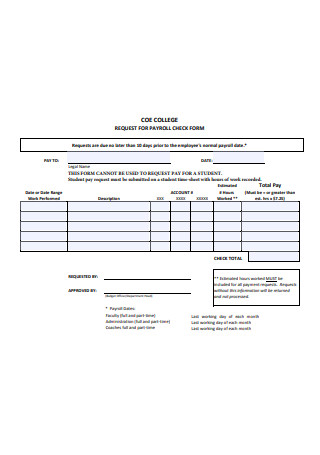

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Web minus any tax liability deductions withholdings Net income Income tax liability Pre-tax deductions Post-tax deductions Withholdings Your paycheck. Ad Compare This Years Top 5 Free Payroll Software.

Just enter the wages tax. Ad Compare This Years Top 5 Free Payroll Software. Web The following steps allow you to calculate your salary after tax in Arkansas after deducting Medicare Social Security Federal Income Tax and Arkansas State Income tax.

Web For employers who pay employees in Arkansas use this guide to learn whats required to start running payroll while keeping compliant with state payroll tax. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. Last Updated on March 11 2023 Use our free Arkansas paycheck calculator to determine your net pay.

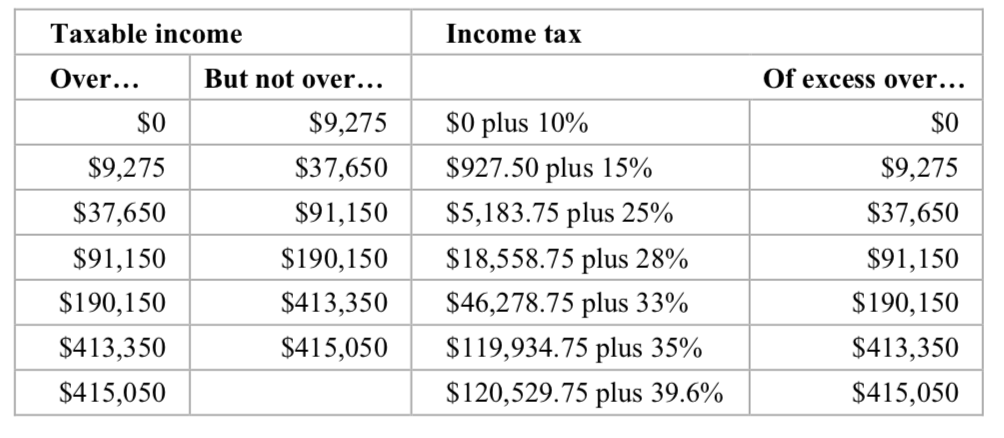

Web Rates for Arkansas unemployment tax vary and range between 01 to 50. Web First you must know the income tax rates. Employers can use it to calculate net.

Instead you fill out. Web Arkansas Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and. Web Arkansas Paycheck Calculator Use ADPs Arkansas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Web Paycheck Calculator Arkansas - AR Tax Year 2023. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Web Free Paycheck Calculator. A stabilization rate that changes each year is added to come up with your total tax rate. Get Started With ADP Payroll.

Web The state income tax rate in Arkansas is progressive and ranges from 0 to 55 while federal income tax rates range from 10 to 37 depending on your income. That means that your net pay will be 43968 per year or 3664 per month. Free Unbiased Reviews Top Picks.

Get Started with up to 6 Months Free. All Services Backed by Tax Guarantee. Lets Talk ADP Payroll Benefits Insurance Time Talent HR More.

Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Your average tax rate is 1167 and your marginal tax rate is 22.

1111 West Keene Road Apopka Fl 32703 Compass

Arkansas Paycheck Calculator Smartasset

9uhz O1kcqbsdm

Free Arkansas Payroll Calculator 2023 Ar Tax Rates Onpay

34 Sample Payroll Checks In Pdf Ms Word Excel

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Arkansas Times May 14 2015 By Arkansas Times Issuu

2525 Huffine Mill Road Mcleansville Nc 27301 Compass

Obesity In Children And Young People A Crisis In Public Health Lobstein 2004 Obesity Reviews Wiley Online Library

How To Calculate Payroll Taxes Wrapbook

Vb Net How To Find Federal Taxes Based On Salary Ranges Stack Overflow

Tax Withholding For Pensions And Social Security Sensible Money

![]()

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

Insurancenewsnet Magazine September 2019 By Insurancenewsnet Issuu

How To Calculate Payroll Taxes Wrapbook

Solved Extra 4 3 Develop The Income Tax Calculator In This Chegg Com

Contrails 166 By Gary Ferguson Issuu